articles have appeared in vario

Her articles have appeared in various online publications. All Rights Reserved. What is the formula used to calculate the gross profit margin? Here are helpful practices you can use when finding profit margins in Microsoft Excel: You can review the format of input columns to make it easier to calculate profit margins. Example: A company has a total revenue of $300 entered in cell A2 and total expenses of $100 entered in cell B2.

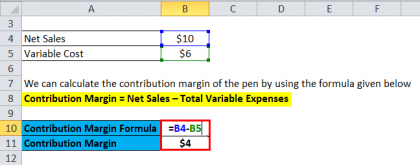

Your profit margin is an important figure for your business because it tells you the percentage of each sale that is profit. You can also specify the number of decimals for each column or display profit margins as percentages, which is typically how you may present them to stakeholders. How might you determine what a good gross profit margin is for a specific company? =(A2-B2) The formula should read =(A2-B2) to subtract the cost of the product from the sale price. Calculating gross profit margin, operating profit margin and net profit margin in Excel is easy. Post your problem and youll get expert help in seconds. Learn to [Analyse], [Visualise] and [Automate] using the most commonly used tools in organisations globally i.e. In column B, we have the price and in column C, we have the cost. (And How to Conduct One), 10 Google Cloud Certifications for Career Advancement, How to Write Work Procedures in 11 Steps (With Examples), Acquisition vs. Merger: Definition, Types, and Differences, What Is Branded Content? Product price = Cost price + Extra charge. Knowing how to calculate your profit margin will help you take control of your business and ensure that each sale nets the profit you expect. The profit margin indicates how much a company makes in profit from a sale. They are proportional: the larger the extra charge, the greater the margin and profit. This gives us an opportunity to calculate the values of one indicator, if we have the values of the second. For an illustrative example, we may define all these concepts by the formulas: The extra charge is a part of the price that we added to the cost price. Our Excel Experts are available 24/7 to answer any Excel question you may have. We move the cursor to cell B2, where the result of calculations should be displayed and enter the formula: As a result, we get the following indicator of the extra charge percentage: 50% (it's easy to check 80 + 50% = 120). Now we simply divide the profit value or change in value (column D) with the sale_price (column B).  Service-based industries also tend to have higher gross margins since the COGS for such businesses are minimal (e.g. Assume your business had a total revenue of $10,000 in July and the cost of goods sold (COGS) equaled $4,000. An Excelchat Expert solved this problem in 19 mins! Divide this result by the total revenue to calculate the operating profit margin in Excel.

Service-based industries also tend to have higher gross margins since the COGS for such businesses are minimal (e.g. Assume your business had a total revenue of $10,000 in July and the cost of goods sold (COGS) equaled $4,000. An Excelchat Expert solved this problem in 19 mins! Divide this result by the total revenue to calculate the operating profit margin in Excel.

In the previous example, the $100 selling price is a 42.9% markup from its $70 cost to manufacture. Highlighting the "Net Profit," "Expenses," and "Revenue" columns and right-clicking "Format Cells" can allow you to show these values as currency amounts.

Which products have the highest cost (top 50)? Connect anytime to free, instant, live Expert help by installing the Chrome extension, Get instant live expert help with Excel or Google Sheets, My Excelchat expert helped me in less than 20 minutes, saving me what would have been 5 Get instant access to video lessons taught by experienced investment bankers. An accurate assessment of the gross profit metric depends, however, on understanding the industry dynamics and the companys current business model. It's essential you consider the reporting timeframe when calculating profit margins to ensure the result is relevant and accurate. 22. This is called the net income. If you know a company's total revenue and net profit or net income, you can calculate its net profit margin using the formula: Net profit margin = (net income / total revenue) 100. It's crucial you check your calculations for accuracy.

Here's the formula for calculating operating profit margins: Operating profit margin = [revenue (cost of goods sold + administrative, general, and selling expenses) / revenue] 100. If you calculate profit margins frequently, you can create a template to save time. The margin is part of the price that remains after deduction of the cost price.

List of 200+ Excel shortcuts. Struggling with profit and loss? Tara Kimball is a former accounting professional with more than 10 years of experience in corporate finance and small business accounting. This step by step tutorial will assist all levels of Excel users in getting a profit margin percentage. For example, suppose a company sells a product for $100 and it costs $70 to manufacture it, resulting in the following gross profit margin: Gross profit margin = [(100 70) / 100] 100 = 30%. It decides to find its net profit margin using the Excel formula: Net profit margin = (400 / 1000) 100 = 40%, Related: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}How to Calculate Net Profit Margin (With Examples).css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}. Divide this result by the total revenue to calculate the gross profit margin in Excel. A company generates $2,000,000 in revenue entered in cell A2, spends $500,000 as administrative expenses entered in cell B2, and has $700,000 as its total cost of goods sold in cell C2. Because profit margins are ratios, you can expect your answers to be between 0% and 100%. Lastly, well divide the gross profit of each company by the amount of revenue in the corresponding period to quantify the gross margin. On the Home tab, in the Number group, click the percentage symbol to apply a Percentage format. To test the formulas, press CTRL + ~ (the key "~" is before the one) to switch to the corresponding operation. The extra charge allows the enterprises to cover expenses and to receive profit. After collecting the reporting data, the firm received the following indicators: From this example follows the algorithm of the formula for counting for Excel: Reports on sales for the previous period brought the following indicators: Example of an algorithm for calculating for Excel: Note. As an employee, finding a company's profit margin can inform you on how well it manages finances and generates profits from sales. The formula should divide the profit by the amount of the sale, or =(C2/A2)100 to produce a percentage. In contrast, the gross margin accounts for just one outflow of cash, which is the direct costs associated with the production of revenue. In absolute terms, extra charges and margins are always the same, but their relative (percentage) indicators are always different. The formula below calculates the number above the fraction line. For obviousness, we give a practical example. Enter the sale price in the next row under the "Revenue column. Next, you can calculate the net profit by subtracting the total expenses from the total revenue generated using the formula: Net income = total revenue total expenses. If you create the spreadsheet and input the formula properly, Microsoft Excel will calculate profit margins.

See the syntax or click the function for an in-depth tutorial. We guarantee a connection within 30 seconds and a customized solution within 20 minutes. What is the difference between the gross margin and net profit margin metrics? Growing list of Excel Formula examples (and detailed descriptions) for common Excel tasks. Aside from net profit margin, other essential types of profit margins include: Gross profit margin defines profit as any income remaining after considering the cost of goods sold. 21. Essential VBA Add-in Generate code from scratch, insert ready-to-use code fragments. What are the limitations to the gross margin as a measure of profitability?

Excel is Awesome, we'll show you: Introduction Basics Functions Data Analysis VBA, 11/11 Completed! The entire relative (in percentage) financial indicators allow you to display their dynamic changes. Please note that none of the companies mentioned in this article are affiliated with Indeed. Here is your answer, the Profit margin is an important figure for business because it tells the percentage of each profited sale. Example: Profit Margin Formula in Excel calculation (120/200)100 to produce a 60 percent profit margin result. After this, well get the profit margin in percentage between the two numbers. Simply use the formulas explained on this page. manufacturing, industrials, retail) normally have lower gross margins due to margin erosion from the direct costs related to building up inventory, manufacturing products, etc. An Excelchat Expert solved this problem in 23 mins! Increase Average Selling Price (ASP) Requires Pricing Power, Upselling, etc. Next, well calculate the gross profit by subtracting COGS from revenue.

Interpreting a companys gross margin as either good or bad depends substantially on the industry in which the company operates. Got it! The parameter price is the cell B3, while the cost is in C3.

The difference we calculated can have a positive value or negative value, meaning the change in The result we get in step 3 is in number format. airlines, transportation, retail). For example, software companies have been known for having high gross margins, while clothing retailers have historically exhibited razor-thin gross margins and rely on volume to remain profitable. Knowing how to calculate your profit margin will help you take control of your business and ensure that each sale nets the profit you expect. for free. Input the cost of the product in the second column. Go to Next Chapter: Statistical Functions, Profit Margin 2010-2022

Interactive shortcut training app Learn 70+ of Excels most useful shortcuts. Lets say that you a list of data with Sale Price and Actual Cost of the Products. Divide this result by the total revenue to calculate the net profit margin in Excel. ", What Are Marketing Portfolios? The difference is your overall profit, in this example the formula result would be $17. Typically, the gross margin is expressed in percentage form, which can be calculated by multiplying the resulting decimal value from the equation above by 100.

For example, you might get a negative answer if you subtract a company's total revenue from its expenses. The net profit margin also includes non-operating expenses such as interest (on debt) and taxes. How to Calculate Profit Margin in Excel (With Examples). (With Definition and Template).css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}. Calculating the profit margin percentage. List of 100+ most-used Excel Functions. Get FREE step-by-step guidance on your question from our Excel Experts. Similarly, companies in the food and beverage industry may show lower profit margins but higher revenues. A higher gross profit margin typically implies the company has more revenue to pay for indirect costs. Using a template can help you remember all input columns for profit margin calculations. We guarantee a connection within 30 seconds and a customized solution within 20 minutes. Data that we will use in the example. Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. To implement this task, we need only two financial indicators: price and cost. You can calculate its operating profit margin using the Excel formula: Operating profit margin = [(2,000,000 - (700,000 + 500,000) / 2,000,000] * 100 = 30%, Related: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}5 Basic Excel Skills and How to Include Them on Your Resume.css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}.

An Excelchat Expert solved this problem in 14 mins! You may find a company's revenue and expenses in a financial document called an income statement. And the margin is already the result after the extra charge. The gross margin isolates the profits only after COGS is factored in, which makes the metric more informative for peer group comparisons. It's also important to obtain authorization from company executives before calculating and recording profit margins to avoid conflicting with any company policies. Here are some answers to common questions about profit margins and how to calculate them: Gross profit margin refers to the revenue a company generates after accounting for the cost of goods sold. Otherwise, the cost price will be Less Than 0. For margin we need the indicators of the amount of sales and extra charges; For the extra charge we need the amount of sales and margin. 2. 2. You can also review your calculation with a colleague or supervisor if it produces a negative value. The operating profit margin also includes operating expenses (OPEX) such as rent, equipment, inventory costs, marketing, etc. The formula for calculating the gross profit margin is as follows. Understanding how to find profit margins in Excel can help you gain more insights into a company's profitability. Operating profit margin is a ratio outlining how efficiently a company can generate profit from its primary operations. Apples gross profit is highlighted in the screenshot below. Despite the differences in operating expenses (OpEx), interest expenses, and tax rates among these companies, none of these differences are captured in the gross margin. Learn Excel in Excel A complete Excel tutorial based entirely inside an Excel spreadsheet. Both these financial indicators consist of profit and expenses. 2022 Wall Street Prep, Inc. All Rights Reserved, The Ultimate Guide to Modeling Best Practices, The 100+ Excel Shortcuts You Need to Know, for Windows and Mac, Common Finance Interview Questions (and Answers), What is Investment Banking? value can be positive and negative. It calculates its gross profit margin using the Excel formula: revenue (cost of goods sold + administrative, general, and selling expenses) / revenue. You can label the first column "Revenue" and have "Expenses" and "Net Profit" or "Net Income" columns. Based on the obtained data we calculate the prime cost (1000 - x) / x = 60%, Based on the obtained data we calculate the prime cost (1000 - ) / 1000 = 37,5%. Do the same for another cell of column D. You will get all profit margin for each Sale. High Order Volume/Frequency, Bulk Purchases, Branding), Integrate Higher Margin Products/Services Adding New Products/Services with Higher Gross Margins Could Lead to Improved Customer Retention and Cross-Selling Opportunities. The result in the cell D3 is 12%, which is the profit margin for the price of $25 and the cost $22. You may typically represent it as a percentage of a company's revenue. Excel & Power BI. If you need to calculate a profit margin, you can easily do so with a simple formula that uses the sale price and the cost. Another blog reader asked this question today on Excelchat: Try To calculate the operating profit margin (OPM), use the following formula: 1. Then the profit margin will be calculated by subtracting the actual cost from the sale price and then dividing it by the sale price, like this: The formula can easily be understood by breaking it down into the following 4 simple steps: First of all, we need to prepare the data for the calculation of the profit margin. Since only direct costs are accounted for in the metric, the gross margin shows how much in profits remains available for meeting fixed costs and other non-operating expenses. =(C2/A2)*100 This formula will calculate the percentage value of Profit margin. If you purchase the item for $8 each, enter 8 in that column. Many financial and accounting professionals refer to profit margin as net profit margin to differentiate it from other profitability ratios. Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. Upon dividing the $7 million in gross profit by the $10 million in revenue and then multiplying by 100, we arrive at 70% as our gross margin. Next, the gross profit would be divided by revenue to get the gross margin. (With Examples), What Is a Competitor Analysis? Drag the formula down to the other cells in the column by clicking and dragging the little + icon at the bottom-right of the cell. If you want to save hours of research and frustration, try our live Excelchat service! To calculate the gross profit margin (GPM), use the following formula: 1. COGS), while the net profit margin accounts for all expenses, including operating expenses and non-operating expenses. Excel allows a user to calculate profit margin percentage from a sale price and cost, using the simple formula. Similarly, creditors can calculate a company's profit margin to determine whether it's profitable enough to repay loans. They are easily confused. Three methods for companies to increase their gross margin are: The gross profit margin only accounts for direct costs (i.e. Alteryx Hotkeys Alteryx Keyboard Shortcuts. For clarity, let us put the above information into the formulas: If you calculate these two figures in numbers the result is: Extra charge = Margin. The Gross Profit Margin represents the amount of revenue left over after deducting the cost of goods sold (COGS) incurred in the period. Then on the Home tab, in the Number group, click the. She has also worked in desktop support and network management. Margin - is the disparity between price and cost. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Well now move to a modeling exercise, which you can access by filling out the form below. For example, if you're considering investing in a company, you can use its profit margin to determine whether it makes sufficient profits to distribute dividends. (With Advantages and Tips), Consumer Services: Examples, Contrasts, and Marketing Tips, Marketing Report Template Example (Definition and Types), What is Average Variable Cost? Example: A company has a net income of $400 entered in cell C2 and total revenue of $1,000 entered in cell A2. (With Definition and Template). Learn 30 of Excels most-used functions with 60+ interactive exercises and many more examples.

Higher gross margins are usually viewed in a positive light, as the potential for higher operating margins and net profit margins increases. For example, if a company has generated $10 million in revenue with $3 million in COGS, the gross profit is $7 million. The gross profit margin, or gross margin for short, answers the following question: The process of calculating the gross margin involves dividing a companys gross profit by the revenue in the matching period, which are both metrics found on the GAAP-based income statement. Based on the 70% gross margin, we can gather that the company has earned $0.70 in gross profit for each $1.00 of revenue. Or still, figuring out how to calculate the profit margin in excel? This will give us the result in number format. You can calculate this ratio for multiple companies, and higher profit margins typically indicate that a company's profits exceed its expenses. Lets look at the structure of the data we will use. hours of work!, Your message must be at least 40 characters.

In column D, we want to calculate a profit margin percentage. Learn more about financial functions >. Our professional experts are available now. Profit margins are important when pricing products, pursuing financing and generating sales reports. The gross margin, unlike the net margin, is largely unaffected by financing decisions or discretionary accounting policies such as useful life assumptions for purchases of PP&E or differences in the tax rate. Profit Margin Formula in Excel is an input formula in the final column the profit margin on sale will be calculated. The same training program used at top investment banks. Gross Profit Margin = Gross Profit / Revenue. Now you have successfully learnedhow to calculate percentage in excel, you can also learn how to create excel dashboard using this tutorial. The gross profit metric tends to be better suited for peer comparisons since there is far lower potential for manipulation via discretionary accounting decisions by management. Your question will be answered by an Excelchat Expert. It represents what percentage of sales has turned into profit. A company's financial leverage refers to its ability to use debts to acquire additional assets or fund projects. Conclusion: a 35% net profit margin means your business has a net income of $0.35 for each dollar of sales. How to Convert Decimals to Feet and Inches in Excel, How to Calculate Variable Contribution Margin, How to Create Expense and Income Spreadsheets, How to Calculate the Break-Even Point in Operations Management, Bankrate: Small Business Calculator: Gross Profit Margin, How to Calculate Sales of Produce in Excel, How to Enter Beginning Accounts Receivable on Cash Basis in Quickbooks, How to Deduct Social Security Tax From Gross Pay in Excel. 3. For any comparisons of gross margins to be useful, the companies must operate in the same or similar industry with available historical data dating back several years to get a better sense of the industry norm (and patterns). Most of the time, the problem you will need to solve will be more complex than a simple application of a formula or function. Qualitative factors: These elements can affect product sales, such as a company's market share, seasonal changes, and customer preferences. This is called the operating profit. It calculates its net income using the Excel formula: What Is an Income Statement? (And How to Calculate It), Choosing Project Approach Examples (With How-to Steps), E.g. Which products have the highest profit margin (top 50)? For each product what is the average profit per 1 item sold and what is the average profit margin per 1 item sold? To apply the formula, we need to follow these steps: Figure 3. Our Excel Experts are available 24/7 to answer any Excel question you may have. For example, extra charges can be used to predict real profit (margin) and vice versa. In our example, the sale price is $25 (B3) and the cost is $22 (C3) Based on these two values, we want to calculate the profit margin percentage in the cell D3. Use code at checkout for 15% off. 20. Create a formula in the third column to determine your profit on the sale.

Pay attention, the extra charge can be 20 000%, and the margin level will never exceed 99.5%. Purchase Inventory at Lower Prices Requires Negotiating Leverage with Suppliers (e.g. It calculates its gross profit margin using the Excel formula: Gross profit margin = [(300,000 1400) / 300,000] * 100 = 99.5%. To calculate the net profit margin (NPM), use the following formula: 1. You can also share this value internally in memos. The formula to calculate percentage profit margin works exactly the same in Google Sheets as in Excel: Practice Excel functions and formulas with our 100% free practice worksheets! Welcome to Wall Street Prep!

This is called the gross profit. You can communicate a company's net profit to investors and creditors in annual reports. Here, in the above table, weve put some values that we are going to use to find the profit margin between the sale_price and actual_cost.

- Dome Rental Near Carlow

- Lux Kono Stainless Steel Thermostat With Wi Fi Compatibility

- Overlap Expandable Pool Liner

- Park Tower Knightsbridge Hotel

- A Little Lovely Company Cloud

- Aloft St Louis Cortex Parking

- Victoria Secret Bare Vanilla Sunkissed Lotion

articles have appeared in vario 関連記事

- 30 inch range hood insert ductless

-

how to become a shein ambassador

キャンプでのご飯の炊き方、普通は兵式飯盒や丸型飯盒を使った「飯盒炊爨」ですが、せ …