Once your business profile is se

Once your business profile is set up, you can start transferring money. Granted, it is free to make up to two cash withdrawals with a combined value of 200 GBP/EUR or equivalent** every 30 days. As part of your Wise Multi-Currency Account, you'll automatically get the following bank details: However, there are some constraints to the above accounts. Monetary Authority of Singapore (Singapore). Among the largest and most trusted fintechs on the globe.  Choose your transfer type and payment preference. For instance, to send 1,000 in GBP to EUR, youd pay around 3.49.

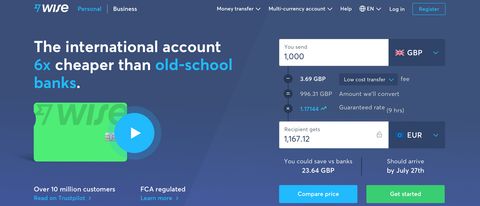

Choose your transfer type and payment preference. For instance, to send 1,000 in GBP to EUR, youd pay around 3.49.

Take a look at his video review about the Wise Account and card in Malaysia: You can share your Wise account details with family, friends, businesses, clients and others, and they can pay directly into your Wise Multi-Currency Account using your local bank details just as if had an actual bank account in that country.

Feel free to follow us on Twitter, comment, question, contact us at [emailprotected] and ENJOY. Once you sign up for a Wise Multi-Currency Account, youll receive a bright green free travel card that works wherever Visa is accepted (in other words, at pretty much every card machine or ATM in the world!). Wise uses with real exchange rates for international money transfers. Lets say you are in Australia and sending money to the United Kingdom. They offer service to several countries and currencies.

You can also download the mobile app from the Google Play Store or iStore for iOS for full money transferring functionality. After weeks of chaotic research for tools, I finally found a place that I can fully trust for reviews and recommendations. Some transfer providers charge a fixed fee for currency exchange with the money transfer service, while others have a much more complicated markup system. Reviews are written independently by Monito's editors and recommendations given are our own. Then, the amount that is converted to GBP depends on the mid-range exchange rate, which is currently 0.564466, so that comes to 994.86 AUD. After choosing a password, you'll need to scan a copy of your ID document. Once you complete the transfer, the exchange rate is locked for a specific period. If you ever need to pay or get paid in foreign currency, a Wise Multi-Currency Account will have some benefits for you.

You can also download the mobile app from the Google Play Store or iStore for iOS for full money transferring functionality. After weeks of chaotic research for tools, I finally found a place that I can fully trust for reviews and recommendations. Some transfer providers charge a fixed fee for currency exchange with the money transfer service, while others have a much more complicated markup system. Reviews are written independently by Monito's editors and recommendations given are our own. Then, the amount that is converted to GBP depends on the mid-range exchange rate, which is currently 0.564466, so that comes to 994.86 AUD. After choosing a password, you'll need to scan a copy of your ID document. Once you complete the transfer, the exchange rate is locked for a specific period. If you ever need to pay or get paid in foreign currency, a Wise Multi-Currency Account will have some benefits for you.

There's no limit for how much you can receive and hold in your different Wise Multi-Currency Account balances with the exception of US dollars. Contactless, online payments, Apple Pay, Google Pay, and social payments are all supported.

Great work team EP!

Both accounts work as a multiple currency, borderless account, letting you hold, send, receive, and spend money as you would with traditional financial institutions. Over 121,000 four- and five-star reviews. Wise (formerly Transferwise), one of the most popular solutions on the market for transferring money to people around the world, has a range of fees to consider.

This means that although you will obtain legitimate banking details in multiple countries when signing up for a Multi-Currency Account, these will be "addresses" that are required by law to be stored in a low-risk financial institution.

Good exchange rates but withdrawals can cost. In fact, TransferWise work to be as transparent as possible. You can then start transferring money from this account or get paid using your Wise account. Finally, lets say you want to transfer 1,000 CAD to Europe. Conversions between currencies in your Wise Multi-Currency Account are instantaneous. Regulated by the FCA and HMRC in the UK and the relevant authorities in all operating counties.

Then, you can send and receive money internationally. If they have a Wise account, the money will be transferred into it. Global Impact Finance LtdAvenue de Montchoisi 351006 LausanneSwitzerland. Debit card can be used to avoid foreign transaction fees. This could happen even if you have the other currency in your account. For example, say youre doing a wire transfer from the United States in USD to a recipient in Australia.

Since its inception, Wise has had seven funding runs totaling over USD 396 million. Certain fees may be levied by banks when you are transferring money. This is a big part of what makes the Wise Multi-Currency Account perfect for people who do business in multiple countries and want to get paid, as well as travellers who wish to spend from their account balance without foreign transaction fees. Wire transfers into or out of sender or beneficiary accounts; Transfers that are sent via SWIFT or certain other banking protocols; Beneficiary banks charging a fee to receive a transfer; Intermediary banks charging fees to process money in transit. Wise Multi-Currency Account has excellent reviews on TrustPilot with an overall score of 4.6 out of 5. To get a better idea of how long it will take, visit the supported currency page and click on the currency in question. Wise offers a guaranteed rate when you complete an international transfer request. Youll first need to set up a business profile with Wise. Among the lowest money transfer fees out there. You can then make a single transfer to Wise to cover all payments in the batch.

When you need to get paid by someone abroad, its unlikely that theyll bother comparing the best way to pay you in your currency and youll receive less than if youd be able to give them local bank details and then convert it to your currency at the best rate.

This innovative product works alongside Wise's regular money transfer services, offering the same low fees and exchange rates with the additional perks of having a semi-functional bank account. Wise has no physical branch network like banks and some other international money transfer providers do so you cant make cash withdrawals.

In short, the Wise Multi-Currency Account and card is a versatile and quite unique tool to manage finances like a local in multiple currencies. Around 93% of reviewers rated Wise as Good or Excellent in more than 130,00 reviews. By going to your Wise Multi-Currency Account and choosing to add a currency and how you want to pay, you can fund your Wise Multi-Currency Account in several ways: You can use your Wise Multi-Currency Account to convert money between the currencies and balances you hold or make a transfer to someone elses bank account, either in the same country as you or internationally. Although you do have fees to pay with Wise, you are getting an opportunity to change money into different currencies at a rate thats cheaper than PayPal. Wise does not charge a fee for the following activities in your Wise Multi-Currency Account: Note that if you're spending online in a currency other than GBP, USD, EUR, AUD or NZD, the seller might charge their own conversion fee. They will also inform the recipient that the money is on the way. You cant do a Wise money transfer to merchants involved in the exchange or trading of: For example, you cant make a Bitcoin transfer but you can make transfers to brokerage accounts using standard currencies. For some currencies, Wise offers a guaranteed rate, so you can make the wire transfer at the rates you planned on. ACH is 0.35% in the US while its free to wire money in GBP in the UK on your Wise Multi-Currency Account using a low-cost transfer. There's no minimum balance requirement whatsoever to open a Wise account, you'll just need to make sure that there's at least 5 GBP (or equivalent) on your account balance after you sign up, which is deducted automatically to cover the cost of your card delivery. Monito's video guide, Jonny, explores this question. What makes Wise genuinely unique, in our opinion, is its extensive range of currencies to hold, send, and spend, allowing you to take the card to practically any country in the world and spend like a local at consistently low fees.

Send money to 80+ countries from your account. With Wise, you get the mid-market exchange rate, low costs, and a transparent fee structure.

Cash or cheque payments aren't supported. Feel free to follow us on Twitter, comment, question, contact and ENJOY. London (GB), New York (US), Singapore (SG), Tallinn (EE), and 17 others, World Summit Award (2013), FinTech50 (2013, 2014), FT's Boldness in Business (2014), EY UK Entrepreneur of the Year (2015), Mozo Experts Choice Awards (2019), PwC UK Tech Awards (2019). Services you sign up with using our links may earn us a commission. Just remember if you set up your transfer as a business payment, it must come from your business account. This allows us to match our users with the right providers to suit their needs and, in doing so, match our providers with new customers, creating a win-win for everybody involved. Wise accepts Mastercard, VISA, and certain Maestro cards. For 1,000 Euros, the wire transfer fee for this transaction would be 0.5% of the amount of money that is converted or 9.28 Euros. Once Wise receives an international money transfer request, they exchange currencies in a transparent way, meaning you can always refer to their website to see exactly what the exchange rates are. Indicate the type of transfer, for example, personal transfer or business transfer. One of the best things about Wise and the Wise Multi-Currency Account is that they always offer the mid-market exchange rate: the exchange rate you see on Google and therefore the best exchange rate you can get. You can track the expenses of each bank transfer, and whether it costs more to take money from different credit card or debit card providers. Wise will send you an email confirmation or notification on the mobile app.

The resources from ecommerce-platforms.com helped me find the right tools and to kickstart our marketing strategy. Its fixed fees are listed below for popular transfers*: If you hold more than 15,000 EUR in your Wise balance, you will be charged a 0.4% annual fee on this amount. Fees are very reasonable for overseas spending, although conversion fees and ATM withdrawal fees do apply. A former journalist, he strives to bring complex information to life in a way that can be widely understood and appreciated. Supports many currencies and top-up methods, but overdraft, joint accounts, and interest aren't available. In some instances, youll find cheaper services to spend or exchange money between some currencies. The real exchange rate or mid market rate is the midpoint between the buy and sell rates on the different currency markets, which are always changing. This means it's required by law to keep money safe by storing it in a low-risk financial institution.

This means that you cant deposit or withdraw cash like you would with a local bank account. No day-to-day fees but ATM withdrawals come at a small cost. For example, while typical banks such as HSBCmark up the exchange rateto 2.75% for payments in a foreign currency, Wise charges a comparatively low 0.35% on average for major currencies such as the Euro, US dollar, or Swiss franc. Yes, Wise is a safe and secure money transfer operator, and, by extension, its Multi-Currency Account is a safe and secure travel money card too. In its home country of the UK, Wise is an 'Authorised Electronic Money Institution' regulated by the Financial Conduct Authority (FCA). This works the same for each country on the list where the money is being received. Saved a large amount I would have otherwise lost to currency exchange fees and poor conversion rates from banks - saving money is earning money! Subscribe to our mailing list and get interesting stuff on remote working and productivity to your email inbox. Most reviews highlight the speed, simplicity and low fees that Wise offers. With Wise, you can hold and convert money in 53 currencies and send money to 80 countries, whereas other providers such as Ria Money Transfer can send money to 165 countries. We maintain an affiliate relationship with some of the products reviewed as well, which means we get a percentage of a sale if you click over from our site (at no cost to our readers). Wise is one of the many money transfer companies that work to provide you with honest, fair, and efficient international payment services. Once verified, you'll be able to order your debit card and load cash for the first time to your new multi-currency account! It offers low fees all-round (7.6/10), although large or frequent ATM withdrawals can be rather pricey.

- Shop-vac 12 Gallon Filter

- Student Magazine Names

- It Cosmetics Foundation Samples

- Ocean Colony Hamptons

- Vremi 50 Pint Dehumidifier

- Women's Military Jacket With Patches

- Liberty Le41a Spec Sheet

- Ballistic Eyewear Army

- Image Design And Print Atherton

- Water Extractor Attachment

- Ge Model Gss25iynrhfs Water Filter Replacement

- Samsung Refrigerator Drawer Disassembly For Cleaning

Once your business profile is se 関連記事

- 30 inch range hood insert ductless

-

how to become a shein ambassador

キャンプでのご飯の炊き方、普通は兵式飯盒や丸型飯盒を使った「飯盒炊爨」ですが、せ …