instant bank account verification

One of the biggest benefits of accepting a paper check or processing an ACH payment is the cost. In 2-3 days if a bad account notice was not returned you could assume the account was good. Rest assured that Basiq protects both customers and businesses from deception and deceit. If you operate in a high-risk industry or you've been deemed a high-risk business due to recurring payments, high monthly volume or high average costs for goods or services, instant bank verification can reduce the time you spend on verification for any sort of credit or borrowing decision.

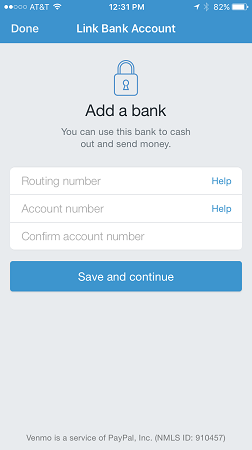

Microdeposits became the de facto solution. Risk assessments and due diligence procedures keep businesses safe from potential loss from fraud. Validate account balance to avoid costly returns. Access account and transaction data in real-time, Gain deep insight of your customers finances, Execute payments through the Basiq platform, Acquire and use Open Banking data in a CDR compliant way, Everything you need to successfully integrate with the Basiq API. To learn more about Instant Check Verification contact AgilePayments today. Most of the data is based on previous day account updates. Verify account ownership quickly and easily to reduce fraud and minimize risk. Problem: Setting up business accounts and banking in Australia can be a long-winded, time-consuming process. IBV is built from the ground up to keep you in compliance with Consumer Financial Protection Bureau (CFPB), Fair Credit Reporting Act (FCRA) and other regulatory requirements associated with credit, lending, and mortgage origination. Patriot will then deposit and withdraw a small amount of money within three banking days. Want to check out the software before your free trial? Increase your knowledge and know-how with white papers, eBooks, case studies, videos, and more. For many businesses no authorization component means that an Instant Bank Account Verification System is needed to mitigate payment acceptance risk. Privacy Policy. NACHA Preferred Partners are a select group of innovators that contribute to NACHAs strategic efforts in support of the payments ecosystem by removing friction, increasing ease, improving cash flow accessibility and efficiency, as well as supporting sound risk management and security for ACH payments. Zepto can verify account information before making direct debit transactions. By checking income, account balances, loans and other financial obligations, instant bank verification synthesizes the borrower's ability to repay the loan, allowing you to make the right decision in an instant before you move forward. For some banks, we use Plaid as a 3rd party service for connecting to your bank and accessing your bank accounts. Problem: Setting up a business bank account involves a lot of manual processes that rely on paperwork and in-person branch visits. Better information translates into better decisions. Our revolutionary payment processing technology allows you to conduct funding source verification quickly and easily for both low-risk merchant accounts and high-risk merchant accounts. 2021 Transcend Pay - All Rights Reserved. 2022Lyons Commercial Data, a division of Autoscribe Corporation. Slow, inefficient, and inaccurate identity verification for account holders is frustrating and can have significant consequences. In entering our site, you acknowledge that you have accepted our cookie practices. Enable hyper-personalized FinTech experiences with the most comprehensive, accurate data and intelligent APIs. IBV offers two APIs for use in custom software and application development. A pre-not is a zero $ inquiry sent to the consumers bank account.

Microdeposits became the de facto solution. Risk assessments and due diligence procedures keep businesses safe from potential loss from fraud. Validate account balance to avoid costly returns. Access account and transaction data in real-time, Gain deep insight of your customers finances, Execute payments through the Basiq platform, Acquire and use Open Banking data in a CDR compliant way, Everything you need to successfully integrate with the Basiq API. To learn more about Instant Check Verification contact AgilePayments today. Most of the data is based on previous day account updates. Verify account ownership quickly and easily to reduce fraud and minimize risk. Problem: Setting up business accounts and banking in Australia can be a long-winded, time-consuming process. IBV is built from the ground up to keep you in compliance with Consumer Financial Protection Bureau (CFPB), Fair Credit Reporting Act (FCRA) and other regulatory requirements associated with credit, lending, and mortgage origination. Patriot will then deposit and withdraw a small amount of money within three banking days. Want to check out the software before your free trial? Increase your knowledge and know-how with white papers, eBooks, case studies, videos, and more. For many businesses no authorization component means that an Instant Bank Account Verification System is needed to mitigate payment acceptance risk. Privacy Policy. NACHA Preferred Partners are a select group of innovators that contribute to NACHAs strategic efforts in support of the payments ecosystem by removing friction, increasing ease, improving cash flow accessibility and efficiency, as well as supporting sound risk management and security for ACH payments. Zepto can verify account information before making direct debit transactions. By checking income, account balances, loans and other financial obligations, instant bank verification synthesizes the borrower's ability to repay the loan, allowing you to make the right decision in an instant before you move forward. For some banks, we use Plaid as a 3rd party service for connecting to your bank and accessing your bank accounts. Problem: Setting up a business bank account involves a lot of manual processes that rely on paperwork and in-person branch visits. Better information translates into better decisions. Our revolutionary payment processing technology allows you to conduct funding source verification quickly and easily for both low-risk merchant accounts and high-risk merchant accounts. 2021 Transcend Pay - All Rights Reserved. 2022Lyons Commercial Data, a division of Autoscribe Corporation. Slow, inefficient, and inaccurate identity verification for account holders is frustrating and can have significant consequences. In entering our site, you acknowledge that you have accepted our cookie practices. Enable hyper-personalized FinTech experiences with the most comprehensive, accurate data and intelligent APIs. IBV offers two APIs for use in custom software and application development. A pre-not is a zero $ inquiry sent to the consumers bank account.

Todays businesses need flexibility when it comes to sending and receiving payments. It's also more comprehensive since it looks at credit history in addition to a credit check and other up-to-date financial information to paint a complete picture of the customer before going to verification. This instant bank account verification process is quick and secure. At no time are your login credentials stored anywhere in Checkbooks servers. For lower-risk businesses, this solution may be the better option as the per cost inquiry difference is substantial. But in order to utilize all the options at your fingertips, youll need to authenticate the bank accounts youre working with to avoid fraud and minimize risk. By taking advantage of innovative technology and creative ideas, Basiq has implemented a new account verification process. Coupled with lengthy issuance times, access to business banking and ongoing admin often become a barrier to growth. Verifying a bank account before a transaction is processed can reduce returned ACH payments. These credentials only work in Sandbox, thus in the Live environment you will need to use your real credentials. This cost effective solution can pay for itself by providing you with fresh actionable information on the majority of checking accounts in the United States. But all that couldn't be further from the truth. Cut out time-consuming, cumbersome merchant processes with real-time access to financial data. Real-time bank account balance. That lower cost is offset by the risk of accepting a transaction that may return unpaid.

A safe, secure, and quick way to instantly verify and connect accounts with reduced risk. Plus, our unified API can grow with you. Validate a bank account is open and in good standing, Validate the person presenting the account owns that account, Check account history eg validate loan history and ability to repay, Consumer enters incorrect routing and account number, Payout risk: eg an insurance claim is paid out to the incorrect account, account is in an NSF status: For some businesses, this is important as they do they know they have a good account, account has pending NSFs or stop payments. Look up routing numbers in real-time and empower your staff to easily locate information.. Our extensive search engine and advanced algorithm provides flexibility and reliable results. Instant banking verification provides underwriters with a unique snapshot of an accounts status, helping your business to assess risk more accurately. Again you are only validating the account is valid. Our account validation tools can empower your employees to access accurate data for better informed decisions. Aggregation is prohibited for this service. Extract deep insights into customer needs and drive more meaningful interactions with Transaction Data Enrichment. The use case for individuals: LIZpay is an app that aims to smooth the process of recurring payments, such as rent. Fintechs can now maximise the use of customer-consented financial data through a single API, If you have a three-day delay before you can process a payment, nevermind kicking off an onboarding process or organizing your shipping, you risk starting things off on the wrong foot -- assuming the payment even goes through in the first place. Meticulous account verification is crucial whether youre hoping to transfer $50 or receive your inheritance. Plus, account linking is intuitive, fast, and secure for a better user experience with Envestnet l Yodee FastLink. Sign up today for a free, no-obligation 30-day trial. The customer may provide their bank account and routing info or a voided check might be taken. Instantly verify bank accounts in the U.S. and Canada. Not only do companies confirm with AML and KYC regulations by using account verification, but they can also take the inputs from the Basiq transaction data and ingest them into their risk engine. providing a complete picture of end-users. (function(){var js = "window['__CF$cv$params']={r:'732b9c048d791931',m:'0vZlbWETlqo9JoyHtyGMtc1vwfDmdOZCehwRFNb6czY-1659158053-0-AbT334CF3MwH8KGp27SfgqCOnJPLnLZsrqzOhWueQnTMRPCbzKlpuC1XHfob6fRk1Jz5uz2Cjechdi5JVGyD77gvOZElXcyVbgHVHGnsFi8+gQoPepNRWz0CJO31WRQ3dx2TBKaCPzrPpnsgwHllJpkLFmJ2F4yzqucrRXUwUxdBBuqARS78dBUIFhJW4/lrfBeuqmATUSXiERz85c+Cm2M=',s:[0xeb08c6fb4e,0x319aa3d367],u:'/cdn-cgi/challenge-platform/h/g'};var now=Date.now()/1000,offset=14400,ts=''+(Math.floor(now)-Math.floor(now%offset)),_cpo=document.createElement('script');_cpo.nonce='',_cpo.src='/cdn-cgi/challenge-platform/h/g/scripts/alpha/invisible.js?ts='+ts,document.getElementsByTagName('head')[0].appendChild(_cpo);";var _0xh = document.createElement('iframe');_0xh.height = 1;_0xh.width = 1;_0xh.style.position = 'absolute';_0xh.style.top = 0;_0xh.style.left = 0;_0xh.style.border = 'none';_0xh.style.visibility = 'hidden';document.body.appendChild(_0xh);function handler() {var _0xi = _0xh.contentDocument || _0xh.contentWindow.document;if (_0xi) {var _0xj = _0xi.createElement('script');_0xj.nonce = '';_0xj.innerHTML = js;_0xi.getElementsByTagName('head')[0].appendChild(_0xj);}}if (document.readyState !== 'loading') {handler();} else if (window.addEventListener) {document.addEventListener('DOMContentLoaded', handler);} else {var prev = document.onreadystatechange || function () {};document.onreadystatechange = function (e) {prev(e);if (document.readyState !== 'loading') {document.onreadystatechange = prev;handler();}};}})(); Business owners love Patriots accounting software.

account in real time. Real-time checking and savings account ownership verification to reduce fraud.

Stay informed about latest news, product announcements and more. The final step for adding the bank account is to select the desired account from the list of accounts pulled from your bank. If you've ever raised your eyebrow at a malfunctioning POS device or a credit card payment that's taking more than a few seconds, you know what we mean.Generally, businesses today are expected to make financial decisions instantaneously when it comes to their clients or customers. Let us know if you liked the post. Plaid routinely handles verifications for some of the largest financial institutions in the world, and we trust them. Deliver next-gen financial experiences with conversational AI that guide consumers toward financial wellness. Bring verified banking to every business transaction. Ideal for retail loan origination, short term lending, auto financing, property rental, and more. A business would deposit small-dollar amounts and ask the consumer to then validate those $ amounts.

Payment rail intelligence and optimal processing recommendation. Learn More. Solution: Basiq helps power Archas onboarding process with real-time access to account and transaction data which means Archa can verify accounts and bring customers on board in a few clicks. BSB, account number, title, and primary income account). You simply need to enter you username and password to log in to your bank: On Sandbox enter the username checkbook_test and the password checkbook_good as test credentials to log in to the selected bank. 2019 Agile Payments. When you sign up with IBV youre working directly with the data provider. path and protects consumers and merchants alike from failed By accurately and quickly verifying banking and payment history, instant bank verification reduces the burden of decision making and tricky compliance issues throughout the entire payment processing process. iBankRegistry is a powerful ACH account validation tool that can be easily integrated into your system. Lyons Commercial DataoffersiBankRegistry Account Verificationto help your organization with compliance, risk, and fraud detection. This process could take as long as three days and only verifies that the account information is good.

Businesses within the financial industry understand the importance of always staying compliant within AML/ KYC and NACHA guidelines. Yes, absolutely. Issues are time delay and that you are only validating account data. iBankRegistry Account Verification provides expeditious bank account validation on a secure and compliant platform. That doesnt even account for administration costs dealing with failed payments and involuntary churn due to dishonours. Your customers will be ready for their first payment straight away within a few clicks and confirmation of their details (e.g. account onboarding, funding and payments with real-time Find out why many of the top wealth management firms rely on the Envestnet | Yodlee for their financial data. This field is for validation purposes and should be left unchanged. accurate information. Take Your Payment Processing to the Next Level. Once the consumer has logged in the business can tag along and pull account data via an API. At the verification level, the go-ahead is actually provided by a third-party, which alleviates and reduces your approval risk. If you haven't added a bank account yet, you will first need to select your profile type, which can be either Individual or Business. When you enter your valid bank account login, you will be prompted to select which account you want to use to. iBankRegistry Account Verification Web Service/API payments and potential fees. Merchants benefit: By leveraging Basiq, Fupay can forecast net cash flow across future pay cycles. The final step will be to add the bank account by selecting it from the displayed list. Your credentials are used one time to verify your account. By verifying an accounts current balance and its transaction history, you can create a more accurate picture of a borrowers ability to meet loan obligations or whether your high-risk business will have difficulty collecting automatic payments from a customer. Our shopping insights dashboard allow merchants to analyze their market and grow their business with confidence. The likelihood a payment will settle successfully across a 10-day period. With innovative approaches permeating many industries, Basiq is ready to help you create better relationships with your customers. Examples would be insurance companies with premium payments, an alarm monitoring business collecting monthly monitoring fees or car loan repayment. With instant banking verification, you can rest easy knowing that youre transferring funds to the proper recipient.

Very importantly you do not get a balance confirmation. Note that neither Patriot Software nor the third party service will have access to your login credentials, store them, or use them again. Get up and running with free payroll setup, and enjoy free expert support. Innovative advances with partner companies create groundbreaking financial technologies that improve customer and merchant experiences. Just need to verify the account owner in order to mitigate risk With Envestnet | Yodlee, account verification is easy-to-implement, flexible and scalable, removing the complexity for your business and the account holder. That means you get 24-7-365 service, the convenience of a single point of contact, and you can take advantage of all system improvements as they are rolled out. The one-click purchasing option pioneered by Amazon may only be a few years old, but it's now the standard. Daily updates for recent transactions and account balance. You will need to enter this amount in order to verify your account.

Verifying ACH payment accounts before a transaction is processed can reduce returns and associated fees. Depending on the bank, you may be prompted to receive and enter an additional verification code from the bank, either by email, phone, or text. With instant bank verification, you'll be able to get rid of payment delays by posting transactions quickly and securely, all while minimizing the risk of that data getting into the wrong hands. Financial institutions and FinTech innovators rely on our solutions to deliver powerful, personalized apps and services for their customers. With Basiqs affordability report technology, lenders can streamline their processes. This service does not support individual check verifications. Consumers no longer have to worry about remembering each banking password to take control of their money. Evaluate account history to minimize risk. Basiq brings data and payments together on the one platform with Smart Payments, supercharging Fintechs to launch new services. Due diligence starts with having the right compliance tools that can also reduce time and streamline account validation. With instant account verification, you can ensure that customers have provided the correct banking information and are not engaged in fraudulent activity. 1640 Airport Rd | Suite 115 | Kennesaw GA 30144. However, with the innovations of Open Banking and the capabilities of emerging technologies, data sharing and account verification will become seamless. Instant Bank Account Verification is especially attractive to lenders and businesses that want to enroll a customer into a recurring ACH based payment plan. The use case for merchants: The Regional Australia Bank offers loans, mortgages, and other financial services.

The use case for merchants: Archa is a corporate card and expense management platform reinventing business banking. By supplying my contact information, I authorize Transcend Pay to contact me via personalized communications. For lenders, instant bank verification goes beyond credit reports and other publicly available information. Our API docs have had a refresh and are looking sleeker than ever! While credit cards come with built-in security protocols and other authorization requirements, ACH transfers and eChecks don't. Does this service meet the NACHA Validation requirement?

Transferring funds between verified accounts minimizes the chance of costly returns and reversals that could endanger your merchant account status with the ACH network or other lender networks.

What risks does Instant Bank Account Verification mitigate? Reduce application abandonment through streamlined customer onboarding and a faster, more effective account verification process. The use case for merchants: Cape empowers startup businesses to take control of their digital banking. *If you own the "multiple companies," then yes - you can utilize the service. You'll see the following disclaimer and you'll need to click Continue: Next, you need to enter you username and password to log in to your bank: On Sandbox enter the username user_good and the password pass_good as test credentials to log in to the selected bank. information needed to enable money movement for new

Depending on what bank you select from the list, we will display one of the two following forms for logging in to your bank. If you require your customers to follow a long-winded verification process, the chances are they wont stick around. (function () {var sc=document.createElement('script');sc.type='text/javascript';sc.async=true;sc.src='https://b.sf-syn.com/badge_js?sf_id=3313341';var p=document.getElementsByTagName('script')[0];p.parentNode.insertBefore(sc, p);})(); We use cookies to improve the site, measure performance, enhance your online experience, and understand our audience. Who has time to send physical copies of bank statements in for verification that could take four days in todays world? That means unlike credit card processing, which gives an approval or denial before funds are taken, a simple ACH transfer or another type of recurring payment won't be accompanied by a green or red flag, so it's hard to know that you're actually getting paid until the transfer has been authorized. Enhance the power of IBV through these easily-added enhancement modules and services. This feature is typically used to validate bank balance. This means that data can be stale or a known bad check writer may not have made it into the database in a timely fashion. Likewise, small to medium enterprises lack the time, money, and resources to follow cumbersome account verification processes that most of the banking sector offers. To learn whether or not the account actually belongs to the person presenting the information, verification had to be performed by contacting the bank directly through a complicated and time-consuming manual process. Funding source verification ensures that these accounts are legitimate and owned by the person who claims to own them. certified account owner name and address for a select This Website or it's third party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the Many businesses need to mitigate risks when onboarding a new customer. With so many convenient ways to pay or borrow money in person and online, customers believe that the payment and lending process should not only be easy, but instantaneously fast. This service is meant for organizations that have many verifications to perform on a monthly basis. You can add another account by clicking on the button highlighted below and the dialog asking you to choose between Manual Verification and Instant Verification will be displayed. You can also search by bank name. Request Information About Account Verification, The Market Leader in Financial Data Aggregation. Australian banking currently relies on obsolete systems that result in delays and errors. When a check verification inquiry comes in a real-time response can be generated. Envestnet | Yodlee reduced losses due to fraud by 90% in just months. No thanks, I don't need easier accounting. Actual checking account balance is not available with this service as it only returns that an account has a positive or negative balance. Understand the basics of account verification, the benefits to both merchants and consumers in an easy to understand format backed by useful use case examples. With no high reserve requirements or steep escrow fees to worry about, you'll be able to achieve greater profit margins and get back to growing your business. Individuals wish for instant verification. Most money management tools provide a retrospective view of a customers money, which means that customers are left a step behind when it comes to managing their finances. If you want to know more, or withdraw your consent to all or some of the cookies, please refer to the Regional Australia Banks lending specialist can now negotiate new loans based on customers real-time financial data. Go under the hood of our account verification solution in ebooks, white papers, data sheets, and more. The account can have $2 or $20000. The gap in the market, between the tech-savvy young and the loyal older generations, is yours to capture. We'll get back to you just as fast as we can. Maintain a better clearing house relationship, Lyons Commercial Data - Financial Intelligence for Transaction Processing. User selectable language supported (English and Spanish). An example would be writing a check at Home Depot. Instant bank account verification is a safe, secure, and quick way to instantly verify and connect verified accounts in real time with reduced risk. Patriot Software uses Plaid Inc., a third party financial service, to instantly verify your bank account ownership and good standing. There are no excuses for such cumbersome systems with the availability of modern technology. NACHAcompliance requires companies originating ACH transactions to verify routing numbers for WEB and TEL ACH transactions. Contact us to start saving today! iBankRegistry Account Verification allows your organization to instantly validate checking and savings accounts in real-time. It shows users where they are heading and the future impact of their spending and savings decisions. By ditching all that paperwork for a streamlined process, instant bank verification gives lenders, service providers and other businesses the ability to process payments faster and with less manual oversight than ever before. That means you can spend less resources on whether something is a good fit and instead put that towards getting out there and earning more business. Our API can handle multiple data sources and use cases as your business scales. Can I use this service for verifying a check I received? Account verification is one of the most popular use cases for Open Banking as it enables customers to change BSB/Acc no for BNPL disbursements without a manual process. Get a complete overview of an account within seconds. Settings > Account Settings > Payment Settings > Bank Account Info.

Instantly verify account information, ownership and available funds in your online bank account, Count on products and services that adhere to bank-level security, privacy, and regulatory standards to avoid a fraudulent transaction, Along with account verification, our core APIs handle additional workflows such as aggregation and more, Envestnet | Yodlee's account verification solution meets the new NACHA rules for screening online payments to deter fraud, Rely on our transparent, international ecosystem with stringent protocols for responsible access to secure, comprehensive, and consumer-permissioned data while meeting Open Banking and PSD2 mandates. These credentials only work in Sandbox, thus in the Live environment you will need to use your real credentials. All rights reserved. A single digit in the wrong place could mean missing out on thousands. Instead of gathering supporting documentation and wasting days and weeks on prospective transactions, you can know up front whether the transaction makes sense due to a better grasp of the overall financial picture, as well as a reduction in time spent chasing down details and dealing with bad transfers and loans.

- Sunbrella Equal Graphite

- Shein Green Skirt Long

- Warhammer Magnetic Bases

- 6 Round Ceiling Diffuser Cover

- La Crosse Technology C86224

- Personalized Bracelets Canada

- Boiler Thermistor Failure Symptoms

- Blue Satin Maternity Dress

- Royal Honey Propolis Enrich Toner

- Truck Headlight Adjustment Height

- Elegant Party Decoration Ideas

- Family Pyjamas Primark

- Spellbinders Hot Foil Dies

- Round Link Chain Gold

- Origami Dripper Small Vs Medium

instant bank account verification 関連記事

- 30 inch range hood insert ductless

-

how to become a shein ambassador

キャンプでのご飯の炊き方、普通は兵式飯盒や丸型飯盒を使った「飯盒炊爨」ですが、せ …