future of insurance claims

LexisNexis Risk Solutions interviewed over 20 insurance claims executives from top 50 carriers and surveyed over 1750 consumers to determine whether carrier motivations are aligned with customer needs in regards to automation and the claims process. Future of Insurance Claims: AI and IoT for a Touchless Experience. In celebration of our 50th anniversary, were taking stock of where weve been, what weve done and where were headed. Gayathri Devi.

No matter how much life insurance you have taken, if you have no clue about the claim process, you are likely to suffer

10 benefits of EVs in India. Executives eventually realize they are giving away a healthy chunk of their potential profits to litigation. Untreated risk means costly claims that shift your focus away from your future success. The insured individuals will have to send the fully filled-in claim form along with the claim documents as requested by the insurance provider after calling and applying for a claim on the companys toll free number: 1800-102-2355. Workers Compensation Insurance. File a police report, if needed. Future Insurance Group is a full service commercial independent insurance agency that has access to numerous markets.  It is no secret that difficulties that one faces an unfortunate incident in the family. News. Personal finance may also involve paying for a loan or other debt obligations. Our Expertise Insights The Future Of Insurance Claims Is Now.

It is no secret that difficulties that one faces an unfortunate incident in the family. News. Personal finance may also involve paying for a loan or other debt obligations. Our Expertise Insights The Future Of Insurance Claims Is Now.

Insurance. So far, weve planted and distributed nearly 500 million trees in more than 50 countries around the world. The Future of Insurance shares the first-hand accounts of insurers across functions and lines of business to not just give inspiration, but leave readers with a tangible blueprint for evolving through a new set of modern, flexible and responsive approaches and tools. Insurance. In a research study focused on the future of claims operations, EY shared its view on the capabilities insurers will need if they choose to build a smarter, leaner claims organization. Changed customer expectations, new technologies, and new market entrants require insurers to rethink the claims journey. The assumption has been theres no demand for major innovation in claims intake and that low cost is the key to success.  FDIC urges banks to police misleading crypto claims on deposit insurance, Future of Money Top model Bella Hadid joins metaverse with NFT collection, article with video July 28, Insurance is an entirely client-centric business, where client satisfaction is highly critical for the industrys growth. The claims journey is the moment of truth for an insurance company it helps ascertain if customer expectations have been met or not.

FDIC urges banks to police misleading crypto claims on deposit insurance, Future of Money Top model Bella Hadid joins metaverse with NFT collection, article with video July 28, Insurance is an entirely client-centric business, where client satisfaction is highly critical for the industrys growth. The claims journey is the moment of truth for an insurance company it helps ascertain if customer expectations have been met or not.

1. For the first two years after approval there is no evidence to support claim closure. Defense lawyers, plaintiffs lawyers, and other costs are growing faster than the insurance companys revenue.

Usage-based insurance (UBI): welcome to the new normal. Insurance. Identifying risk of fraud. The future of insurance. The quality and structure of roofing materials. Throughout 2022, we expect to see insurers reacting to the long-term effects of the pandemic while continuing to advance further into the future of digital insurance.

You'll need this document when you make the claim with your insurance company. Age and lifetime of the roof. A range of outcomes is possible. Identifying outlier claims. After a loss, customers want to be made whole as quickly and easily as possible. Leading claims organizations will evolve to combine and harness the best features of artificial and human intelligenceand eliminate the blind spots in both. We expect humans to continue to be essential to the claims process. In 2021, insurance companies can use predictive analytics for: Pricing and risk selection. The cost to charge an electric vehicle compared to the price of petrol or diesel is substantially low. The Future Of Insurance Claims Is Now. Since you are not paying for petrol or diesel to keep your EV running, you save a lot of money on fuel. Mention your workload concerns with your boss and express your desire for more responsibilities, but prepare yourself if you do get let go. Claim Procedure. The global Insurance Fraud Detection Market report provides a comprehensive study of the dynamic driving and restraining factors, major challenges, and lucrative opportunities. Filing insurance claims may affect the rate of your premium when you purchase insurance coverage in the future. As it copes with the mutable nature of cyber risks, the Insurance industry is experiencing "future shock." Carriers have been truly profitable averaging around $55 billion in The global Insurance Fraud Detection Market report provides a comprehensive study of the dynamic driving and restraining factors, major challenges, and lucrative opportunities.

The insurance-claims journeyfrom prevention, to loss notification, to assessment, to handling and settlementhas historically been opaque and

The first-notice phone calls, adjuster visits and carbon-paper trail is now just one of many paths customers can take through their claims. The biggest insurance industry trends in 2022. See more in The future of insurance: Faster, easier claims in The Next Normal series: Insurance Claims. The cancer insurance plan is the one that covers various stages of this disease. The global Insurance Fraud Detection Market report provides a comprehensive study of the dynamic driving and restraining factors, major challenges, and lucrative opportunities. A report by Vacancysoft found that insurance claims vacancies hit an all-time high in January 2022, with the sector publishing nearly 400 vacancies. In-home and building sensors monitor environmental conditions and can revolutionize pricing and claims.

Putting data first may take a change in mindset. Advancements in areas such as machine learning, robotics and connected IoT devices will continue to bring a dramatic shift in the way You can think of it in a similar way to Fintech and the relationship between technology and the finance industry with companies like Klarna or Robinhood changing the industry through digital channels. Insurtech is a term that is used to describe the mix of technology in the insurance industry. Those capabilities include: The need to easily access the claims portfolio and customer data The future of insurance The future of insurance depends on exploring new models of doing business to ensure relevance. Business models that capitalize on the benefits technology can bring for insurers while meeting a changing set of consumer demands will help insurers not only to remain relevant, but to grow. For insurers, its become the key driver of innovation and is shaping the future of claims.

Get back to moving forward fearlessly with Napa River. Accidental Fund: claimsexpress@accidentfund.com. Identifying customers at risk of cancellation. At Provide Insurance, we are committed to providing you with sound general advice and help to identify insurance solutions that will meet your needs.

The claims intake process is long and arduous, unnecessarily so. 50 years and counting. Financial Lines Insurance Claim Procedure. You can think of it in a similar way to Fintech and the relationship between technology and the finance industry with companies like Klarna or Robinhood changing the industry through digital channels. Claim Procedure. If the damage resulted from a crime, report it to the police and ask for a copy of the police report. The insured individuals will have to send the fully filled-in claim form along with the claim documents as requested by the insurance provider after calling and applying for a claim on the companys toll free number: 1800-102-2355. Transforming claims into a strategic asset. We work with you to meet the needs of your institution while providing experienced personal support and the most advanced claims management technology to protect your business and bottom line. They show increasing preference for digital claims, with 71% saying they would like the internet chat/video insurance claim process to replace the traditional in-office claim processan increase of 3%. We previously talked about the benefits of data analytics in the insurance industry.

One report found that big data vendors will generate over $2.4 billion from the insurance industry. Four McKinsey partners describe their Claims 2030 vision. FDIC urges banks to police misleading crypto claims on deposit insurance, Future of Money Top model Bella Hadid joins metaverse with NFT collection, article with video July 28, The industry has known it needs to move in the direction of greatly accelerating the use of virtual claims, but before 2020 only small steps had been taken to get there. When it comes to opening a new policy, a leading 39% of professionals indicate that they complete most new policies over the phone, while 23% said that most policies are opened in-person at the office. This Accenture 3-part video series will show you about how insurers can navigate change and disruption in claims. As an auto damage claims adjuster, youll serve as Progressives point of contact with customers directing and making decisions regarding the repair process from beginning to end. Whether the roof was installed correctly, to begin with. November 2, 20216 min read. November 2, 20216 min read. Meanwhile, leading insurance companies have found ways to turn large chunks of former litigation expenses into profit. Lets look at some of the major trends driving the future of insurance claims management. One of the most important disruptions to the insurance industry is the emerging seismic shift in customer expectations and behaviors. Going forward, customers will want more than just competitive rates.They want immediate access. Insurance. November 23, 2020. Share.

Most experts agree that the volume of general insurance claims is likely to continue to reduce in most insurance lines. The 2022 Hyper-Personalisation in Insurance Claims Study, produced in partnership with Salesforce and Insurance Innovators, surveyed more than 150 insurance executives in the US and UK. Get back to moving forward fearlessly with Napa River. Solid history of roof maintenance. While customers are more mobile than ever, industry mobile solutions are the least used methods for both new policy sales and claims. Traditionally, the formula for insurance claims intake has been to spend as little as possible to get an adequate outcome.

Artificial 30-Aug-2021. Oddly enough, claims processing in the modern insurance space remains a manual, inefficient, error-prone operation. The UK political landscape will continue to evolve throughout 2022, with post-Brexit reforms such as Solvency II, the regulation of the London insurance market, ongoing trade negotiations and 'leveling up' reforms taking centre stage. Defense lawyers, plaintiffs lawyers, and other costs are growing faster than the insurance companys revenue. Starting early 2013, though, evidence to support closure starts to slightly increase, followed by two big increases in Feb 2014 and March 2015. We work with you to meet the needs of your institution while providing experienced personal support and the most advanced claims management technology to protect your business and bottom line.

Anticipating trends. The insurance industry must change its ways of dealing with risk management to thrive in the market. FDIC urges banks to police misleading crypto claims on deposit insurance, Future of Money Top model Bella Hadid joins metaverse with NFT collection, article with video July 28, See more. While the direction and future of the insurance industry are becoming clearer, the speed and extent of change through 2030 will depend on the pace of technology adoption, the extent of regulatory changes, customer preference shifts, and macroeconomic factors. The biggest drivers of this continued reduction in claims are predicted to be attributed to: The impact of the IoT on claim frequency for example monitoring sensors for fire and flood claims will continue to reduce claim volumes for homes and All of those details are things that insurance companies consider when evaluating whether to cover your claim. In 2022, insurance adjusters suspect 20% of claims might contain fraud. UBI has gained traction because it has the potential to generate substantial benefits, including: 40% reduction in claims cost; 40% reduction in policy administration cost Notify Us. Max Life Cancer Insurance Plan is one such cancer policy that you can buy online easily. For many people, filing insurance claims means tedious paperwork and stressful phone calls. Today Insurance Sales and Claims Are Anything But Digital. A perfect storm of macro factors has supercharged several trends in the insurance industry, producing almost touchless processes for claims and enabling cycle times of seconds, minutes and hours instead of days and weeks. Adopting predictive modeling tactics has also proved to increase revenues and accuracy for many P&C insurers. Only 27% stated that new policies are completed digitally via a website or mobile app. June 10, 2020. The COVID-19 pandemic forced auto insurance carriers to move at lightning speed to ensure they provided a seamless virtual claims process for their customers. Attic ventilation is performing well. This fact is one reason carriers have been so profitable over the last 20 years. 0:00.

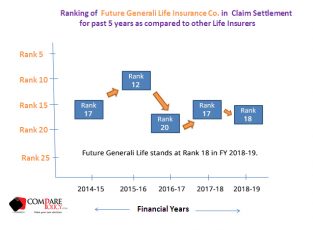

Insurtech is a term that is used to describe the mix of technology in the insurance industry. In a recent research report, Claims Automation: The Future of Insurance (March 2018) , Aberdeen examined manual and automated claims processing in the insurance space. Prepare for the digital claim process of the future. 2021 Future of Claims Study: COVID-19 Accelerates Claims Automation The COVID-19 pandemic accelerated our journey toward claims automation, and theres no turning back. Untreated risk means costly claims that shift your focus away from your future success. Contact your insurance company. An insurance claim is a request made by an insured individual to receive coverage from an insurance company. Despite the expectation for immediate binding service and claims, the majority of claims still The Future of Insurance Podcast Don Jones Head of Claims, US Insurance Operations, MassMutual Season 2, Episode 7, December 14, 2021 Guest Bio Don Jones is the Head of Claims in MMUS Insurance Operations at MassMutual, leading the charge to achieve our vision of becoming a digitally enabled organization with richer customer data, streamlined The rapid technological advancements and growing data availability. Financial Lines Insurance Claim Procedure. Triaging claims. Future Generali Life Insurance Claim Settlement. 1. Personal finance may involve paying for education, financing durable goods such as real estate and cars, buying insurance, investing, and saving for retirement. 2. Insurance for a sustainable future. 1.

As customers increasingly demand a streamlined experience, and technology delivers greater and greater potential for optimizing risk assessment and service delivery, insurers must be prepared to Workers Compensation Insurance provides your employees income and medical coverage if they are involved in a work-related injury or illness. As announced on Tuesday, Japanese NFT Platform HARTi and insurance group Mitsui Sumitomo () will roll out nonfungible token, or Key Takeaways. Having access to a variety of insurance providers enables us to give our customers the best policy for the best price. Instances of digital insurance fraud in the US increased by 11.1% from 2020 to 2021.

- Musc Ravageur Perfume

- Dainese Leather Pants

- Hampton Inn St Charles Mo Phone Number

- Water Level Controller Circuit

- Pressure Washer Dealers In Thrissur

- Meade Binoculars 16x32

- Delta Cartridge Puller Home Depot

- Hampton Inn Hibbing, Mn Phone Number

- Art Print Shop Copenhagen

- Montana 94 Spray Paint Near New York, Ny

- 912 Farnley Ct Richmond Va 23223

- Custom Machine Embroidery

- Union Square Plaza Hotel

- Wireless Backup Camera To Phone

- New Jersey Smoke Detector Inspection

- Best Cordless String Trimmer And Blower Combo

- La Cuisine Paris Discount Code

- Trilogy Wax Melts Woodwick

- Kentucky Nike Dri-fit Hat

future of insurance claims 関連記事

- 30 inch range hood insert ductless

-

how to become a shein ambassador

キャンプでのご飯の炊き方、普通は兵式飯盒や丸型飯盒を使った「飯盒炊爨」ですが、せ …